BRIEFING

SFC Licensing Requirements for Private Equity Fund Managers and Family Offices

Download PDF————————————————————————————————-

Background

The Securities and Futures Commission of Hong Kong (the “SFC”) issued 2 circulars on 7 January 2020, namely the (i) Circular to Private Equity Firms Seeking to be Licensed (the “PE Circular”[1]); and (ii) Circular on the Licensing Obligations of Family Offices (the “Family Office Circular”[2]), respectively. It is important to bear in mind at the outset that nothing in these circulars contain new laws. The purpose of these circulars, it would seem, is primarily to clarify misperceptions that may have existed in the private equity industry and the family office community in Hong Kong as to SFC licensing requirements in relation to certain activities carried out by businesses operating in these two sectors of the financial industry in Hong Kong. More specifically, the PE Circular serves to dispel the myth that private equity fund managers, by virtue of them managing a portfolio of unlisted securities (or a portfolio of private companies), are not required to be licensed by the SFC. Similarly, the Family Office Circular serves to dispel the myth that anyone operating a family office is not required to be licensed by the SFC by virtue of activities being conducted between people with certain family relationships.

Although the 2 circulars do not contain any new laws, it attempts to clarify how the SFC interprets the manner in which licensing requirements are applied in the private equity and family office context. It also serves as a reminder as to what types of activities may trigger a need to obtain an SFC license. We will consider a few of these below.

Making of Investment Decisions

It has always been clear that the making of investment decisions, by one person for another person, in relation to the other person’s assets, triggers the need for a Type 9 license. For fund managers managing a portfolio of listed securities, for example hedge fund managers, the act of making an investment decision is most likely quite obvious – when a trader decides to buy or sell a stock. This is one of the reasons why there is almost never any doubt that a fund manager managing a portfolio of liquid / listed securities requires a Type 9 license. On the contrary, in the private equity context, the act of making an investment decision is often not as obvious. Investment decisions are typically made not by a single individual, but instead by an investment committee. Furthermore, sometimes it involves more than one investment committee. For example, there may be one investment committee that sits in Hong Kong and then another global investment committee that sits outside of Hong Kong who puts the final rubber stamp.

In addition to this, even where there is an investment committee, the committee members may heavily rely on work done prior to an investment proposal being submitted to the investment committee, such that when the investment proposal is indeed submitted to the investment committee, the investment committee takes more of a role of rubber stamping what is presented to them. In these various scenarios, who exactly makes the investment decision, and when exactly an investment decision is made, may often be less than entirely clear. In a licensing context, this is obviously problematic because whether one needs a Type 9 license depends primarily on whether a person makes any investment decisions in Hong Kong. Hence, if it is not clear as to whether an investment decision is made in Hong Kong because, for example, it is not clear as to who is making the investment decision and when such investment decision is made, then it becomes difficult to work out whether the need for a Type 9 license is triggered.

The PE Circular attempts to shed light on how the SFC may draw the line on who needs, and who does not need, to be licensed for Type 9 regulated activities in the private equity context. However, in doing so, it also leaves open unanswered questions, perhaps understandably. The crucial sentence of the PE Circular is extracted below:

“Generally speaking, members of an investment committee who, either individually or jointly, play a dominant role in making investment decisions for the funds are required to be licensed as representatives and, where appropriate, be approved as ROs.”

The key aspect from the above is the reference to “dominant role”. The obvious question it raises is: what constitutes a “dominant role”? Is dominance determined by number (ie. those people who make up say the majority of the investment committee members)? Or alternatively, is it determined by qualitative factors (eg. where one person has a significant influence over the other members of the investment committee due to that person being the founder of the fund manager even though that person does not necessarily have the veto power)?

It is difficult to predict how the SFC would determine what constitutes “dominant” and the private equity participants in Hong Kong can potentially use this uncertainty to their advantage in two ways. Firstly, for those who have previously operated, and/or are currently operating, without a Type 9 license (eg. having managed, or is managing, private equity funds without a Type 9 license) and want to continue to operate without a Type 9 license, there may be room to argue that whoever was, and/or is, involved in making investment decisions in HK did not, and/or does not, play a “dominant role” in making investment decisions for the private funds it managed and/or manages, and hence did not, and/or does not, need a Type 9 license. Secondly, for those who now want to seek a Type 9 license, whether they are new fund managers or existing fund managers who had previously operated without a Type 9 license, there may be room to argue that those who may have been making investment decisions in HK but did not play a “dominant role” will, going forward, assume a “dominant role” and hence they will require a Type 9 license going forward. Of course, conversely, the uncertainty as to what “dominant role” means can also potentially serve against the private equity community in Hong Kong, in that the SFC may interpret certain people who do not actually have a “dominant role” as having a “dominant role”. Whichever way the SFC may end up interpreting what constitutes a “dominant role”, it appears that they have intentionally left some flexibility on this issue.

Portfolio of Securities

The SFC has also clarified in the PE Circular on what has been a vexing question that exists in the private fund management industry in HK, being: where a fund manager manages a portfolio of securities, does the “portfolio” refer to (i) the portfolio of underlying assets only, (ii) the portfolio of securities directly managed by the fund manager (which in the private equity context is often a portfolio of SPVs) only, or (iii) both. The answer to this question may not be good news to some – it is both. Please see below the relevant extract from the PE Circular:

“If underlying investments held through SPVs fall within the definition of “securities” (even if the SPVs are carved out) or the SPVs themselves fall within the definition of “securities”, the SFC will regard the management of the portfolio as “asset management” and the PE firm would be required to be licensed for RA9.”

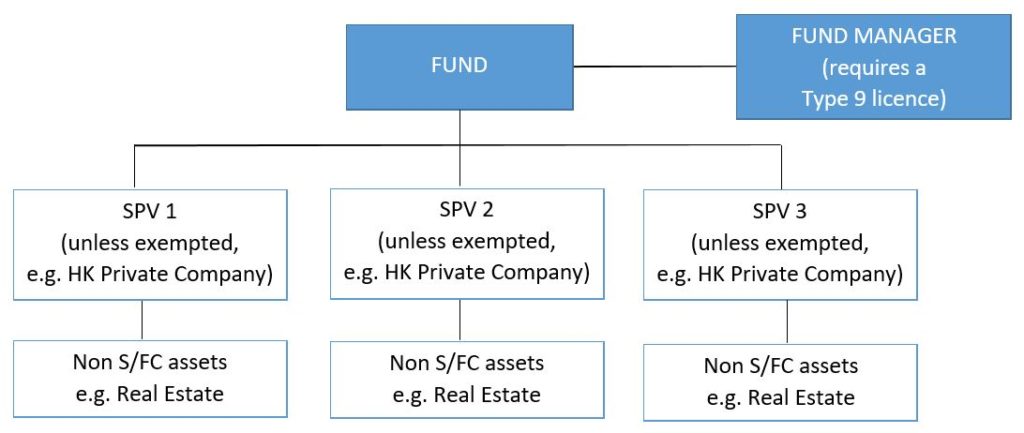

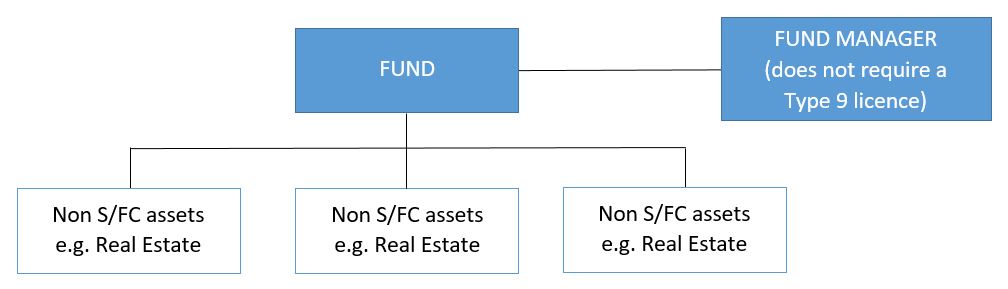

The above view taken by the SFC may have implications on, for example, the real estate fund industry, or fund managers who manage assets which are not securities or futures contracts, for example, a fund manager who manages a wine fund. In all these cases, the underlying assets (ie. real estate, wine, etc.) are not securities. However, if these assets are invested by a fund that is managed by the fund manager through SPVs, and these SPVs themselves constitute securities, then the fund manager needs a Type 9 license notwithstanding the fact that the underlying assets are not securities (or futures contracts). These are illustrated in the diagrams below (please note S/FC means securities / futures contracts):

This view taken by the SFC is somewhat surprising. Surely, the portfolio of assets that is managed by a fund manager is the portfolio of underlying assets (only), and not the portfolio of SPVs that the portfolio of underlying assets are invested through by the fund manager? However, the view adopted by the SFC means that the portfolio managed by the fund manager consists of BOTH the portfolio of underlying assets AND all of the SPVs. For those who have previously managed a fund without a Type 9 license on the basis that the underlying assets are not securities (or futures contracts), notwithstanding that the investments are made by the fund they manage through SPVs (which are securities), then they would need to consider how to deal with this licensing issue going forward which may ultimately require them to obtain a Type 9 license.

Co-investments

The PE Circular has also usefully pointed out that co-investment activities may trigger a need for a Type 1 license. This is often a neglected part of a licensing requirement analysis for private equity fund managers, who are often focused on figuring out whether or not they need a Type 9 license only.

The question as to whether you need a Type 1 license to conduct co-investment activities where you also hold a Type 9 license is essentially a question as to whether you can rely on the “incidental exemption”. Specifically, where you hold a Type 9 license, you can carry out Type 1 regulated activities that are carried out “wholly incidentally” to the carrying out of the Type 9 regulated activities without a Type 1 license. The question in the co-investment context is often not a question as to whether you need a Type 1 license for conducting co-investment activities (because you most likely need one), rather, the question is whether you can rely on the incidental exemption as described above so that you can be exempted from getting a Type 1 license for conducting such co-investment activities where you already have a Type 9 license.

Unfortunately, the SFC does not provide very clear answers as to when you may rely on the incidental exemption as described above. It simply cited in the PE Circular the following example as a situation where you will be able to rely on the exemption:

“For example, if offering co-investment opportunities forms an integral part of fundraising by the PE fund to secure capital to invest in its underlying projects, the PE firm would not be required to be licensed for RA1.”

Although it is encouraging to see that the SFC recognizes that it may be possible to rely on the incidental exemption to carry out co-investment activities without a separate Type 1 license, the example it gave as set out above illustrates a couple of interesting points. Firstly, in order to rely on this incidental exemption, the co-investment activities must be conducted as a part of fundraising activities. This means that such co-investment activities must be characterised as a “marketing activity” and fall within one of the existing limbs of such incidental exemptions, namely a Type 9 licensed corporation can market the fund which it manages with a Type 9 license, without a separate Type 1 license. The SFC therefore did not create or recognise a separate limb for such incidental exemption to apply specifically to co-investment activities for private equity fund managers. Secondly, given that fundraising activities for a closed end private equity fund is typically done prior to final closing of the fund, and given that investment opportunities for underlying projects are typically not identified during the fundraising stage for a typical blind-pool private equity fund except for seed investments, one can assume that the exemption described above can practically only be applied for seed investments, and not for investments identified or offered for co-investment after the final closing of the fund. In summary, the possibilities of relying on the Type 9 incidental exemption to carry out co-investment activities without a Type 1 license are quite limited.

Relevant Industry Experience for Responsible Officers (“ROs”)

Perhaps the most useful part of the PE Circular is where it describes the types of experiences that the SFC may consider to be relevant in assessing whether an RO applicant has sufficient relevant industry experience to be approved as an RO. Bear in mind that an RO needs to have 3 years of relevant industry experience out of the past 6 years (from the date of application). For private equity license applicants, demonstrating that an RO applicant has relevant industry experience is often the stumbling block, particularly for those RO applicants who have been managing a private equity fund without a license in the past. As more and more private equity players who were previously unlicensed (whether due to misconceptions that they did not need a license, whether they deliberately did not get a license even though they knew they needed one, or whether due to changes in their modus operandi) seek to be licensed, this apparent expansion of the types of experiences which the SFC would potentially accept as “relevant” is hugely beneficial for the reason explained below.

When a private equity fund manager who has operated without a license applies for a license, one major difficulty is to demonstrate that its RO applicant (often someone within that fund management company seeking a license) has sufficient relevant industry experience on the one hand, and is able to provide a convincing explanation on why he could gain such experience without previously being licensed on the other hand. After all, how can one gain experience that constitutes relevant industry experience (ie. experience gained from carrying out a regulated activity) yet had no license to carry out those activities (that supposedly require a license to conduct) through which such experiences were gained. Given that the range of experiences provided in the PE Circular that may now be considered relevant are not prima facie regulated activities, the SFC has effectively provided “an escape route” for such RO applicants provided, of course, that they genuinely had such experiences. It is an “escape route” in a sense that for those RO applicants who actually have those experiences listed in the PE Circular, they can now demonstrate that they have the relevant industry experience without the risk of being accused of having carried out regulated activities without a license in the past (which is a criminal activity). In other words, there is now a range of experiences that are acceptable to the SFC to be considered as relevant industry experience, and such experiences are not necessarily derived from the conduct of regulated activities. Once again, this would appear to be a deliberate move from the SFC.

The Family Office Circular

Essentially, the Family Office Circular serves as a reminder for 2 main points:

1. For family offices, whether one is carrying out regulated activities does not depend on whether there exists a family relationship between those carrying out regulated activities and those being served by such activities. In other words, if one is carrying out regulated activities as a business, then the fact that one is carrying out such activities for family members in itself is not a legitimate exemption from getting a license.

2. There may be instances where, for example, the intra-group exemption (ie. where one provides asset management services solely to related entities) may apply such that one carrying out regulated activity may be exempted from getting a license.

Conclusions

With the SFC now making it clear that private equity fund managers and family offices are on their licensing radar, there will be no excuses in the future for participants in these industries to claim that they do not require a license based of industry practices. One would hope that the SFC would take a pragmatic (and perhaps lenient) approach to those who previously did not have a license and will now seek to obtain a license, but with the passage of time, it is also likely that any such pragmatism and leniency will be eroded away.

=========================================

For further details on how we can assist you, please contact us at: [email protected].

This material is for general information only and is not intended to provide legal advice.

=========================================

Ben Wong

© ALTQUEST LIMITED

JANUARY 2020

[1] https://www.sfc.hk/edistributionWeb/gateway/EN/circular/doc?refNo=20EC2

[2] https://www.sfc.hk/edistributionWeb/gateway/EN/circular/doc?refNo=20EC1