BRIEFING

The Hong Kong Open-Ended Fund Company – will it mark the end of the use of offshore funds for Hong Kong private fund managers?

Download PDF————————————————————————————————-

INTRODUCTION

The Open-ended Fund Company (the “OFC”) regime of Hong Kong came into effect on 30 July 2018. With the introduction of the OFC, there is, for the first time, a Hong Kong domiciled corporate vehicle which is suitable to act as a fund vehicle. Previously, limited companies incorporated in Hong Kong were not suitable to be used as fund vehicles because the usual corporate mechanisms regarding capital reduction and distribution that serve the purpose of shareholders and creditors protection rendered them unsuitable for funds that allow for investor redemptions and distribution out of capital. The OFC regime brings Hong Kong on par with major onshore fund jurisdictions such as UK (the OEIC) and Luxembourg (SICAV) in having a type of onshore corporate vehicle designed to be used as a fund vehicle. In devising this new type of legal entity, the Hong Kong government had to strike a balance between ensuring that the entity is workable for the local funds industry on the one hand, and ensuring that the vehicle does not provide a means for tax avoidance, particularly for the real estate industry in Hong Kong, on the other hand. This balance needs to be struck in the macro context of Hong Kong’s role in the modernization of mainland China’s financial industry.

OVERALL FRAMEWORK

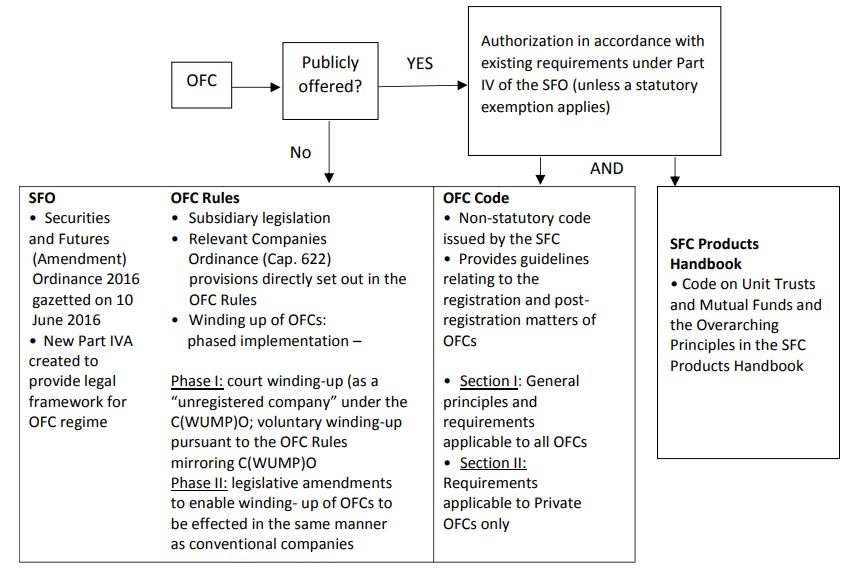

The main conceptual distinction between an OFC and an ordinary company is that an OFC is designed to serve as a collective investment scheme and not as a vehicle to operate a commercial business or trade. The diagram below shows an overview of the legal and regulatory framework governing the OFC regime.

General regulatory framework

Private vs Public OFC

Public OFCs are OFCs which are intended to be marketed to the public and must obtain an authorization from the Securities and Futures Commission of Hong Kong (the “SFC”) and observe requirements that are similarly applicable to funds that are made available to the retail public in Hong Kong (ie. existing SFC authorized funds), which means that public OFCs are required to comply with the relevant requirements prescribed in the SFC Products Handbook for Unit Trusts and Mutual Funds, Investment-Linked Assurance Schemes and Unlisted Structured Investment Products (the “SFC Products Handbook”). Conversely, private OFCs (“Private OFC”) are OFCs which are not intended to be marketed to the public and/or are made available only to professional investors in Hong Kong and hence are generally known as “private funds” (ie. mainly hedge funds and private equity funds). Public OFCs and Private OFCs are subject to different disclosure requirements and different tax treatment as noted in the “Tax Exemptions” section below.

The focus of this article is on Private OFCs.

Structure

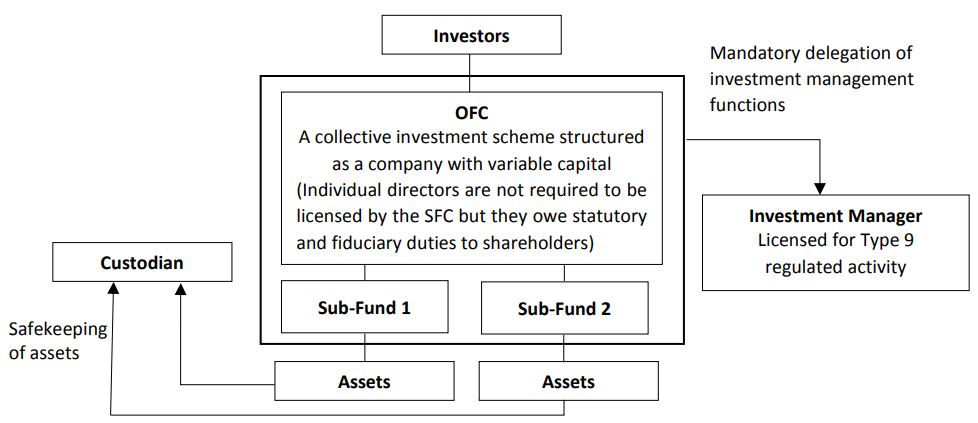

The structure of an OFC would consist of a board of directors (the “Board”), an investment manager(s) and a custodian(s), as shown on the diagram below. The appointment of all of which are subject to the SFC’s approval.

Board of Directors

An OFC must have at least two directors who are natural persons of age 18 or above. There must be at least one independent director on the Board who must not be a director or employee of the custodian.

Investment Manager

An investment manager of an OFC must be licensed by the SFC for Type 9 (asset management) regulated activity. Hence, it must comply with the requirements on valuation, pricing and conflict of interests as set out in the SFC codes and guidelines eg. the Fund Manager Code of Conduct (the “FMCC”) and the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission. All investment management functions (including valuation and pricing) must be delegated to the investment manager. This requirement effectively means that the OFC is not suitable for fund managers other than those based and licensed in Hong Kong (ie. a Singaporean or PRC based fund manager cannot use the OFC as a fund to be managed in those jurisdictions).

Custodian

All the scheme property of an OFC must be entrusted to at least one custodian for safe-keeping and record keeping. The custodian(s) would be subject to the same eligibility requirements of the custodians of SFCauthorized funds in the SFC Products Handbook, which means that the custodian of an OFC has to be (a) a licensed bank in Hong Kong; (b) a trust company which is a subsidiary of such a bank or a trust company registered under Part VIII of the Trustee Ordinance; or (c) an overseas banking institutions or its subsidiary acceptable to the SFC. It will also be required to meet the relevant capital and internal control requirements.

Single Fund Structure / Umbrella Fund Structure

An OFC may operate with an umbrella and sub-funds structure. It may also have both publicly offered and privately offered sub-funds subject to applicable disclosure requirements. Cross sub-fund investments would also be allowed provided that such investments are disclosed in the OFC’s annual reports.

Each sub-fund under the OFC has statutory segregated liability. Each sub-fund is not a separate legal entity but the OFC can sue or be sued in respect of any sub-fund. In order to protect other sub-funds when one sub-fund of the umbrella OFC goes insolvent, terms seeking to segregate the liability of the sub-funds would be implied into the contracts and transactions entered into by an umbrella OFC.

OFC may have different classes of shares and provide for the rights attached to its shares in its instrument of incorporation. Each sub-fund may also have its own different classes of shares.

Private OFCs

Private OFCs are subject to various investment restrictions and disclosure and operational requirements. In particular, at least 90% of the gross asset value of a Private OFC must consist of (1) “securities” and/or “futures contracts” as defined under the SFO (to align the investments of the Private OFC with the types of assets which its investment manager licensed for Type 9 regulated activities can manage); and/or (2) cash, bank deposits, certificates of deposit, foreign currencies and foreign exchange contracts. In the case of an umbrella OFC, such limit is applicable to each of its sub-fund and the umbrella OFC as a whole. In the event such limits are breached, the SFC may revoke its registration.

TAX EXEMPTIONS

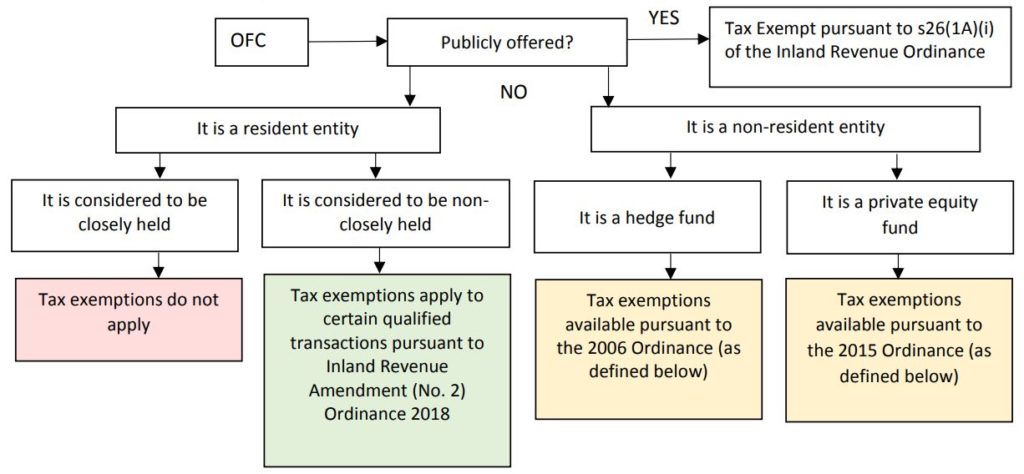

The diagram below shows a brief overview of the tax exemption roadmap which may be applicable to OFCs as the law currently stands, subject to certain conditions being met to reach each possible exemption outcome.

Overview of Tax Exemptions

For a Private OFC, the key factor in determining the eventual tax exemption outcome is whether the Private OFC is considered a resident entity or a non-resident entity. They are binary outcomes which means an entity must be considered to be one or the other in any given point in time. An entity would be regarded as a resident entity if the central management and control of the entity is exercised in Hong Kong in the year of the tax assessment – hence, it is possible for a Private OFC to change its residency status from year to year depending on where its central management and control lies in a given tax assessment year.

The central management and control refers to the highest level of control of the business of a company or an entity and where this lies is determined on a case-by-case basis, but some guiding principles are as follows[1])

• the exercise of central management and control does not necessarily require any active involvement;

• the place where the central management and control is exercised is not necessarily the place where the main operations of the business are to be found;

• the place of incorporation of a company or the place of establishment of an entity is not in itself conclusive of the place where the central management and control is exercised, and is therefore not conclusive of the place where the company or entity is resident;

• in general, if the central management and control of a company is exercised by the directors in board meetings or by the partners in partners meetings, the relevant locality is where those meetings are held. In other cases, central management and control may be exercised by directors or partners in one jurisdiction though the actual business operations may take place elsewhere; and

• the residence of individual directors or partners is generally not relevant in determining the locality of the central management and control of a company or partnership. Therefore, the mere fact that the majority of the directors of a company or partners of a partnership are resident in Hong Kong does not in itself mean that the company or partnership is centrally managed and controlled in Hong Kong, and hence would not adversely affect the application of the tax exemption.

As the above diagram shows, if the Private OFC is considered to be a non-resident entity, then the Private OFC may rely on tax exemptions available under (i) (in the case of a hedge fund) The Revenue (Profits Tax Exemption for Offshore Funds) Ordinance 2006 (the “2006 Ordinance”); and (ii) (in the case of a private equity fund) The Inland Revenue (Amendment) No. 2 Ordinance 2015 (the “2015 Ordinance”). It is unfortunate that the 2006 Ordinance has a reference to “Offshore Funds” in its title because the exemptions available pursuant to the 2006 Ordinance are not limited to “offshore funds”. This misnomer in the name of the 2006 Ordinance creates a misunderstanding that the tax exemptions available under the 2006 Ordinance only apply to funds incorporated in an “offshore” jurisdiction (eg. the Cayman Islands) and causes confusion as to how Private OFCs should be treated for tax purposes in Hong Kong, with the common misunderstanding being that the only available tax exemption outcome for Private OFCs would be the one depicted in the green box in the diagram above.

As explained above, a Private OFC can be treated as a non-resident entity or a resident entity, depending on where its central management and control lies. If the Private OFC is considered to be a resident entity, then it can avail itself of certain tax exemptions pursuant to the Inland Revenue Amendment (No. 2) Ordinance 2018, provided that (i) the requirements of it being a Private OFC are met (although this appears to be stating the obvious); and (ii) it is not closely held. It should be noted that where the relevant criteria for tax exemptions are met, tax exemptions are not applied on the OFC level but instead apply to profits derived from certain qualified transactions and also to profits from transactions incidental to the carrying out of such qualified transactions provided they do not exceed 5% of the total trading receipts from both the qualified transactions and such incidental transactions. In other words, if there are any transactions carried out by the Private OFC which are not one of those qualified transactions and do not fall within such incidental transactions, they are nevertheless liable to be taxed in Hong Kong.

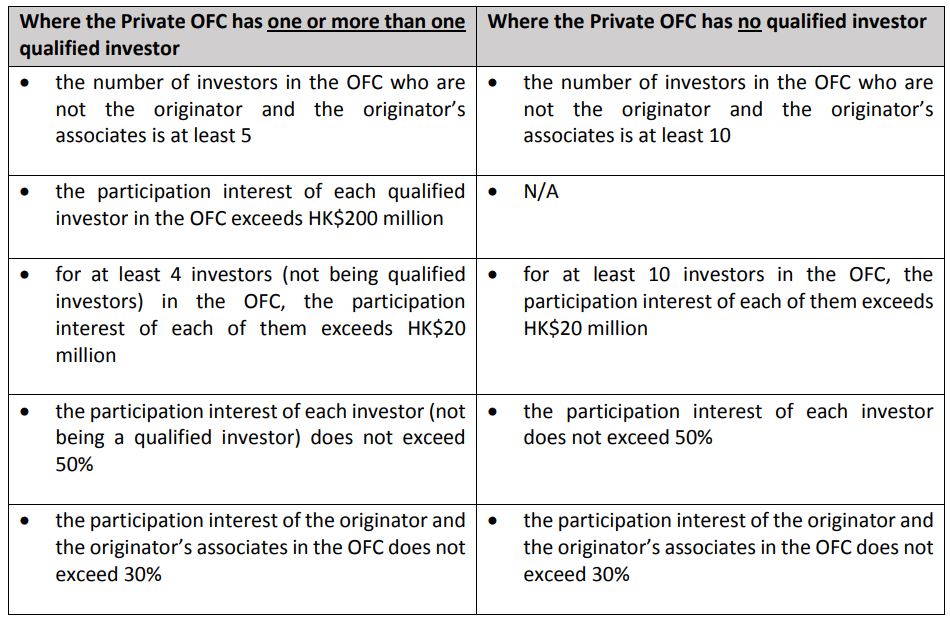

Meaning and Requirements of Non-closely Held

For the purpose of determining whether a Private OFC is not closely held, the ownership requirement imposed on a Private OFC when it has at least one qualified investor ie. certain specified types of institutional investors, which usually has a large number of underlying investors, is different from when it has none. The following table illustrates how a Private OFC may be considered to be non-closely held under these two scenarios:-

For the first 24 months from the date a Private OFC accepts its first investor, it is deemed to have satisfied the non-closely held requirement. However, where such Private OFC seeking to be eligible for the tax exemptions as a resident entity fails to meet the non-closely held requirement at the expiry of the 24 months, the tax exemptions will be withdrawn and such Private OFC will be liable for all the profits tax incurred during the 24-month period.

Proposed Tax Changes

The Council of the European Union (“EU”) has identified the Hong Kong tax regimes which currently provide for different tax treatment on the basis of whether it is centrally managed and controlled in Hong Kong (as explained above) as a harmful tax practice because of its ring-fencing features[2]) . The EU considers that ring-fencing occurs at both the fund level and at the investment level for the following reasons:

• At the fund level – only offshore funds, but not onshore funds (except for Public OFCs), may enjoy

profits tax exemption under the current regimes; and

• At the investment level – non-resident funds with investments in private companies can enjoy tax

exemptions only if the investee private companies fall within the definition of “excepted private

company”. As “excepted private company” (as currently defined) only includes a private company

incorporated outside Hong Kong, non-resident funds cannot invest in Hong Kong incorporated

private companies if they wish to enjoy profits tax exemptions.

As a result, the Hong Kong government has proposed legislative changes (the “Tax Proposals”) so that profits tax exemptions may apply to “funds” operating in Hong Kong, regardless of the type of legal entity or their location of central management and control. In other words, funds will have the same tax treatment in Hong Kong regardless of their place of incorporation and regardless of where they are centrally managed and controlled. The Tax Proposals were put forward for legislative council panel discussion on 5 November 2018.[3]

Under the Tax Proposals, an entity meeting the definition of “fund” which engages a specified person to arrange or carry out its transactions or be a “qualifying fund” may avail itself of certain tax exemptions. This is in line with the existing tax exemptions for “offshore funds”. A definition of “fund”, similar to the definition of “collective investment scheme” in Part 1 of Schedule 1 to the Securities and Futures Ordinance, will be added to the Inland Revenue Ordinance for this purpose. Provided an entity fulfills the definition of “fund”, then tax exemptions are available to it in a similar manner and subject to similar requirements as those available in the tax exemption outcome displayed in green in the above diagram.

Once the Tax Proposals have come into effect, it would mean that Private OFCs would be able to rely on tax exemptions regardless of the location of its central management and control. It would effectively mean that the primary reason for establishing funds in offshore jurisdictions such as Cayman Islands (ie. to ensure that the fund vehicle is not subject to onshore tax) would disappear.

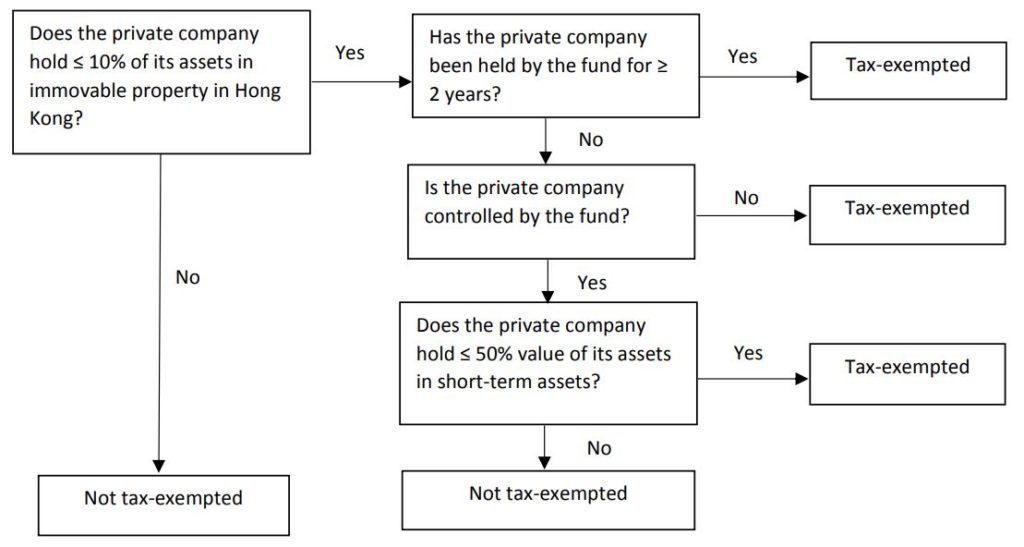

At the investment level, the Tax Proposals provide that a “fund’s” transactions in “qualifying assets” would qualify for tax exemptions in accordance with the following flowchart[4]) . Qualifying assets refer to those assets that correspond to the definition of “securities” and “futures contracts” and other assets which correspond to those currently applicable to Private OFCs and non-resident funds (ie. offshore funds) and, notably, it also includes shares in a Hong Kong incorporated private company:

POSSIBLE BENEFITS OF PRIVATE OFC VS AN OFFSHORE INCORPORATED FUND VEHICLE

It is true that offshore fund structures have had decades of head-start over the use of Private OFCs and will retain much inertia in its usage at least when the OFC is still a relative novelty. However, for a Hong Kong based asset manager, there are a wide range of potential advantages for using a Private OFC over an offshore entity, particularly in light of more recent regulatory developments and commercial realities in Hong Kong and elsewhere. Some of the potential benefits even before the Tax Proposals came into effect are listed below:

| Advantages: | Advantages of Using Private OFC Over: | Description of Advantages: |

| Potential Costs Savings | CIMA registered funds | The current CIMA related fees far exceed SFC related registration fees for an OFC, both for upfront fees and on-going fees. The use of an OFC would lower government related fees. |

| No need for Cayman Islands AML officers | Any type of Cayman Islands fund | Any Cayman Islands funds are now required to appoint a natural person to act as its Anti-Money Laundering Compliance Officer, Money Laundering Reporting Officer and Deputy Money Laundering Reporting Officer pursuant to the Anti-Money Laundering Regulations (2018 Revision). There is no such requirement for an OFC and thereby potentially saving costs and easing regulatory burden. |

| No duplication of regulatory oversight | Any offshore jurisdiction | As the revised FMCC has now come into force, an offshore fund that is managed by an SFC Type 9 licensed entity is indirectly subject to SFC requirements, in particular in relation to disclosure requirements. An offshore fund, particularly those that are registered with an offshore authority (for example, CIMA registered funds), are at the same time also subject to the offshore regulatory authority. The use of an OFC can avoid duplication of regulatory oversight with the OFC being subject to SFC requirements only. Further, in light of the recent strengthening of anti-transfer pricing laws in Hong Kong, the purpose of having an offshore manager has largely disappeared and hence with the use of an OFC, the entire fund structure can be kept in one jurisdiction and thereby simplifying regulatory compliance. |

| Potential Ease of Opening Bank Accounts | Any offshore jurisdiction | As the OFC is an SFC registered entity, it may potentially be easier to open a bank account than in the case for a fund incorporated in an offshore jurisdiction. |

| No need to appoint offshore directors | Any offshore jurisdiction | If the OFC is a resident entity and provided it can be considered to be non-closely held, the OFC would not need to rely on the tax exemptions under the 2006 Ordinance and 2015 Ordinance, thereby saving fees payable to offshore directors. Under the Tax Proposals, it is unlikely that offshore directors need to be appointed in any event. |

| Appeal to certain investors | Any offshore jurisdiction | Having the fund vehicle established in Hong Kong, which is considered to be a leading onshore financial center in the world, may appeal to certain types of investors, in particular global institutional investors. |

| Conversion between a private fund and a public fund | Any offshore jurisdiction | A Private OFC may seek the SFC’s authorization to become a public OFC insofar as it complies with the authorization requirements as set out in the SFC Products Handbook. The Public OFC may potentially qualify under the Mutual Fund Recognition regime. Conversely, a Public OFC may convert to a Private OFC by applying to the SFC for a withdrawal of authorization and complying with the relevant requirements applicable to Private OFCs under the Code of Open-Ended Fund Companies (the “OFC Code”). The OFC regime therefore provides a relatively straightforward mechanism for converting a Public OFC to Private OFC and vice versa. |

GOING FORWARD

As fund managers and investors accept and become more comfortable with the tax position of the Private OFC as stated in this article, Hong Kong based fund managers will increasingly see the OFC as not only an option, but as a sensible, obvious and logical choice for the private funds (and also public funds) which they manage. This would particularly be the case for hedge fund managers who have traditionally used the Cayman Islands limited company or Cayman Islands segregated portfolio company as the default fund vehicle. It would not be long until the use of such Cayman vehicles would be considered a thing of the past for Hong Kong based hedge fund managers, particularly in light of the Tax Proposals coming into effect. Hong Kong based private equity fund managers, however, may consider a more ‘wait and see approach’ in the light of proposed legislative changes to the Limited Partnerships Ordinance of Hong Kong, which is intended to modernize the long-outdated limited partnership laws in Hong Kong and to make limited partnerships established pursuant to it more usable as private equity fund vehicles. Until then, Hong Kong based private equity fund managers may be better off sticking to the tried and tested Cayman Islands limited partnership as the fund vehicle.

=========================================

For further details on how we can assist you, please contact us at: [email protected].

This material is for general information only and is not intended to provide legal advice.

=========================================

Ben Wong

© ALTQUEST LIMITED

NOVEMBER 2018

[1]Extracted from IRD Practice Notes No. 43 (Revised) on Profits Tax for Exemption for Offshore Funds issued in May 2016.

[2]Ring-fencing occurs where the preferential tax treatment is partially or fully isolated from the domestic economy.

[3]The Paper can be accessed at: https://www.legco.gov.hk/yr18-19/english/panels/fa/papers/fa20181105cb1-101-4-e.pdf

[4]Extracted from “Legislative Council Panel on Financial Affairs Proposed Profits Tax Exemption for Funds Discussion Papers”